A Biased View of Estate Planning Attorney

Wiki Article

About Estate Planning Attorney

Table of ContentsThe smart Trick of Estate Planning Attorney That Nobody is Talking AboutThe 2-Minute Rule for Estate Planning AttorneyNot known Facts About Estate Planning AttorneySome Ideas on Estate Planning Attorney You Should Know

Estate planning is an action strategy you can make use of to determine what occurs to your properties and commitments while you're to life and after you pass away. A will, on the various other hand, is a legal file that lays out how possessions are dispersed, that looks after children and family pets, and any kind of other wishes after you die.

Insurance claims that are declined by the administrator can be taken to court where a probate judge will certainly have the last say as to whether or not the claim is legitimate.

3 Simple Techniques For Estate Planning Attorney

After the supply of the estate has actually been taken, the worth of possessions computed, and tax obligations and financial debt paid off, the administrator will then seek authorization from the court to disperse whatever is left of the estate to the recipients. Any inheritance tax that are pending will come due within nine months of the date of death.

Each individual locations their properties in the trust and names somebody apart from their partner as the beneficiary. Nevertheless, A-B depends on have actually become less prominent as the inheritance tax exception functions well for the majority of estates. Grandparents may transfer assets to an entity, such as a 529 plan, to support grandchildrens' education.

The Best Guide To Estate Planning Attorney

This technique entails freezing the worth of a possession at its value on the day of transfer. Accordingly, the quantity of potential resources gain at death is additionally frozen, permitting the estate coordinator to estimate their prospective tax obligation obligation upon fatality and much better strategy for the repayment of revenue taxes.If enough insurance policy proceeds are readily available and the policies are appropriately structured, any earnings tax obligation on the deemed personalities of assets complying with the fatality of an individual can be paid without turning to the sale of properties. Proceeds from life insurance policy that are received by the beneficiaries upon the fatality of the guaranteed are typically revenue tax-free.

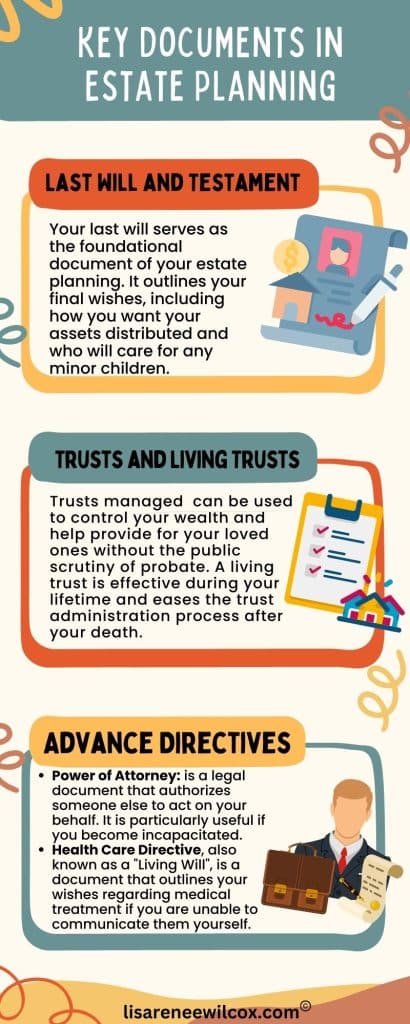

Various other fees connected with estate preparation include the preparation of a will, which can be as reduced as a few hundred dollars if you use among the best online will manufacturers. There are particular files you'll require as component of the estate planning process - Estate Planning Attorney. A few of one of the most usual ones include wills, powers of attorney (POAs), guardianship classifications, and living wills.

There is a myth that estate planning is only for high-net-worth individuals. However that's not real. As a matter of fact, estate Recommended Site preparation is a device that everyone can use. Estate preparing makes it less complicated for people to establish their dreams prior to and after they pass away. Unlike what the majority of people believe, it extends beyond what to do with assets and obligations.

Estate Planning Attorney - An Overview

You ought to begin planning for your estate as quickly as you have any type of quantifiable possession base. It's an ongoing procedure: as life progresses, your estate strategy should move to match your circumstances, in line with your brand-new goals.Estate preparation is frequently image source considered a tool for the well-off. But that isn't the instance. It can be a beneficial way for you to take care of your properties and obligations prior to and after you die. Estate planning is additionally a terrific means for you to lay out prepare for the care of your minor youngsters and pets and to describe your long for your funeral service and preferred charities.

Applications should be. Qualified applicants that pass the examination will be formally certified visite site in August. If you're qualified to sit for the examination from a previous application, you may submit the brief application. According to the policies, no certification will last for a period longer than 5 years. Learn when your recertification application schedules.

Report this wiki page